Why the energy industry is leading the EV charging race

Lowering our carbon footprint is largely done by replacing fossil-based fuels with renewable energy. This is where energy companies and electric vehicles can join forces to create a superpower.

Not only does electric vehicle (EV) charging create new revenue streams, but it can be used as a tool for stabilizing the grid when renewable energy production causes volatility. Still, EVs can’t realize their full potential without energy suppliers— and vice versa.

And it’s not only energy companies that are driving the EV revolution. The competition is growing fierce and several industries are attempting to capture EV charging market share. Currently, there is no clear leader, which is why now is the most opportune time to lead the transformation.

Energy utility companies have an upper hand when it comes to offering new solutions because they already manage most customer touchpoints and data. It’s just a question of leveraging these advantages in time, while there’s still a piece of the EV charging pie available.

The synergistic role of the energy and mobility industries in Europe

In Europe, adopting circular economy principles will not only benefit society and the environment, but an estimated €1.8 trillion in economic growth could be unlocked by 2030.

According to the European Union’s (EU) Circular Economy Action Plan, to achieve climate neutrality goals, the synergies between circularity and the reduction of greenhouse gas emissions need to be beefed up. This will rely heavily on both the energy and mobility sectors.

Transport represents almost a quarter of Europe's greenhouse gas emissions, which means that boosting e-mobility is crucial to achieving climate change goals.

One example of the measures already taken is the EU’s Sustainable and Smart Mobility Strategy, which includes:

- Applying product-as-service solutions to reduce virgin material consumption

- Using sustainable alternative transport fuels

- Optimising infrastructure and vehicle use

- Increasing occupancy rates and load factors

- Eliminating waste and pollution.

The closing window of opportunity in the e-mobility revolution

The EV market is growing approximately 40-80% annually, depending on the market area. Moreover, global political trends and carbon-neutral regulations are fast-tracking the development of e-mobility and smart energy management solutions.

In Europe, countries are rapidly making the transformation. During the fourth quarter of 2020, nearly one in six passenger cars in the European Union (EU) was registered as an EV.

Additionally, the EU’s CO2 standards are requiring that carmakers reach 10% EV sales share in 2021 or face fines. This means the number of EVs in Europe will at least double in the coming years. By 2025, there will be 13 million EVs in Europe and by 2030, that figure is estimated to exceed 44 million.

The EU also has a 750 billion euro stimulus package that includes 20 billion euros dedicated to boosting the sales of clean vehicles. There are already plans to use those funds towards installing 1 million electric and hydrogen vehicle charging stations by 2025.

Many countries are also directing their own national economic recovery investments to build the necessary EV charging infrastructures for future electric vehicle charging.

Fierce competition in the electric car charging market

Funding opportunities, government backing, and the exploding electric vehicle market are just a few reasons why EV charging is a no-brainer for any company willing to innovate and invest early.

The real estate, automotive, and retail industries are just a few of the sizable competitors getting in the game.

Let’s take the petrol sector as an example. As more countries commit to phasing out internal combustion engine (ICE) cars, the petrol industry is in dire need of transforming their business model.

Shell, BP, Chevron, and other giant petrol companies are starting to embrace the idea of offering their customers EV charging.

In 2017, Royal Dutch Shell acquired NewMotion, Europe’s largest EV charging network. As of 2021, NewMotion already has 30 000 public charging points and a customer base of over 80 000 EV drivers.

In 2018, BP followed suit and acquired Chargemaster, the UK’s largest EV charging network. BP also invested heavily in FreeWire Technologies (develops EV fast chargers) and StoreDot (EV-battery developer). Within a year, BP launched the first BP-branded charging station in the UK and plans to roll out dozens more in the next few years.

How smart charging supports renewable energy production and helps balance the grid

Challenge: How can the energy industry use smart EV charging to support renewable energy?

To combat climate change, we need renewable energy and to electrify every part of our society. We all know that renewables cause volatility to our energy systems. They require flexibility and demand response elements to keep the system stable, reliable, and reasonably priced.

In the past, you could pair intermittent demand for electricity against a non-intermittent supply of generation (e.g. coal or gas power stations). When you pair an intermittent supply (solar and wind) against an intermittent demand, energy supply often does not meet demand.

Solution: Smart EV charging

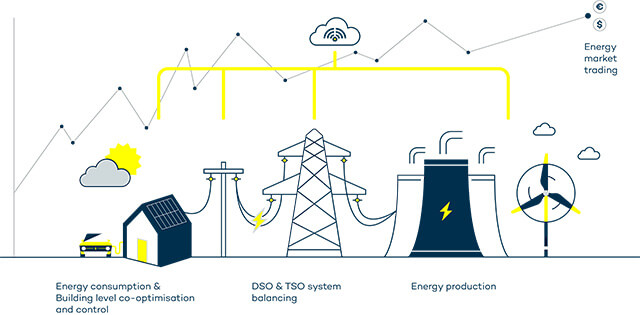

Smart EV charging doesn’t only present a new business model for the energy industry, but it can be a tool for supporting renewable energy and balancing the grid.

Electricity storage can help balance these impacts. This is where electric cars come into play. EVs can provide a critical source of flexibility in our energy system and help stabilize the unpredictability caused by renewable energy production.

Smart EV charging makes optimal use of the energy available during a certain period of time (e.g. storing energy during the day when production is typically high and utilizing the stored energy in the evening, when consumption peaks).

To further the flexibility and effectiveness of smart charging, vehicle-to-grid (V2G) technology enables a car’s charged power to be momentarily pushed back to the grid, in order to balance variations in energy production and consumption.

“For utility companies, this means that EVs offers low-cost energy storage, with no capital cost and reasonable operating costs.”

How can energy companies ride the proverbial EV charging wave?

As cliche as it may sound, timing is everything in this race. The EV charging market is reaching a tipping point and is quickly getting saturated with various industries and companies. This is why timing is of the essence.

Luckily for energy utility companies, they already have access to critical data and customer touchpoints, which can speed up the process for launching an EV charging business. Another way to accelerate entering the EV charging market is by partnering up with EV charging industry leaders like Virta.

Virta is the leading EV charging platform in Europe. Virta can help you fast-track the process of launching your smart EV charging business with our easy and cost-effective charging solutions.

Our Charging Business as a Service gives you the ability to offer EV charging under your brand, while we handle all the complexities of running the service. Your branded smart EV charging solution can be running in a matter of days, rather than months.

New content alerts

You may also like

These related stories

/professional-businessman-with-ev-city-background.webp?width=1920&height=1080&name=professional-businessman-with-ev-city-background.webp)

EV Charging – Why do we need it to fight climate change?

/photovoltaic-panels-reflecting-sunset-sky.webp?width=1920&height=1080&name=photovoltaic-panels-reflecting-sunset-sky.webp)

4 reasons why photovoltaic systems & EV charging are the perfect match

/businessman-using-ev-charging-rfid-card-city-background.webp?width=1920&height=1080&name=businessman-using-ev-charging-rfid-card-city-background.webp)

Real estate sector: Why invest in smart EV charging?

/wind-turbines-road-night-car-light-trails.webp?width=1920&height=1080&name=wind-turbines-road-night-car-light-trails.webp)